McGill University – McGill Tuition

Arry Pandher - April 6th, 2022

If McGill is one of your top choice universities, continue reading to learn more about McGill tuition, overall costs and financial aid options!

Earning a university degree is a huge investment. We know that tuition and related costs can loom large in the minds of driven students. Ultimately, you’re planning for your future career and finances, so knowing as much as possible in the beginning of your educational journey can literally save you money and time in the long run.

General Annual Tuition Fees

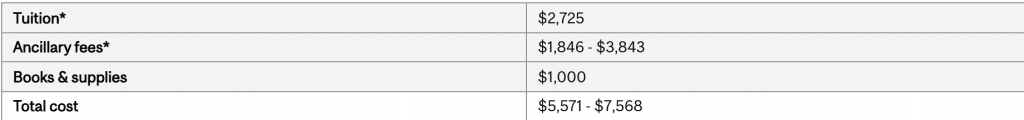

Tuition and fees for Quebec residents

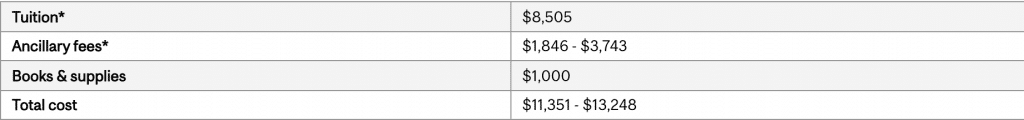

Tuition and fees for Canadian citizens:

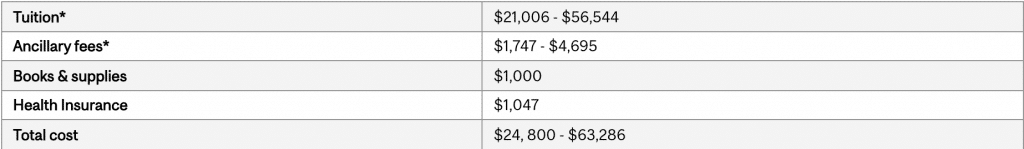

Tuition and fees for International students:

Fees vary by program; make sure to consult the Fee calculator to determine your estimated education costs by your program.

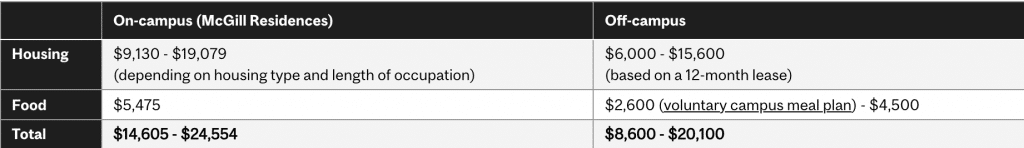

Living costs:

Your living costs will depend on where you choose to live, and how much you spend on things like entertainment and eating out.

If you live off-campus, you might need to factor in things like transportation, internet, heating and electricity. Campus residences are a great choice for first-year students who don’t want to worry about these added costs!

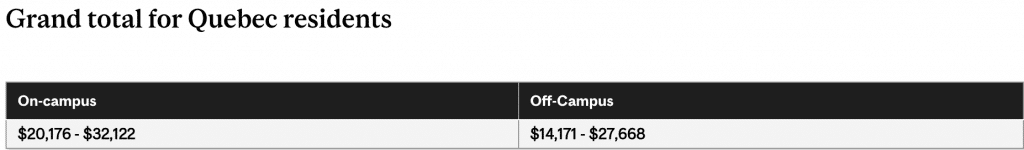

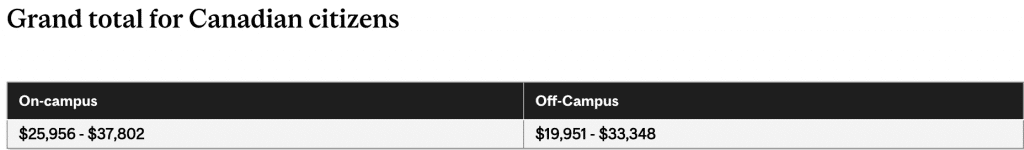

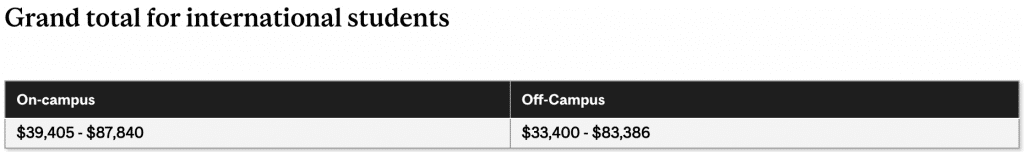

Here are the estimated grand totals for your finances depending on if you live on-campus or off-campus:

Now, we know these numbers look intimidating, but there are multiple financial options available to help you bring these numbers down!

Scholarships and Bursaries

On top of their multiple internal scholarships, McGill’s Scholarships and Student Aid Office offers merit-based and need-based entrance scholarships to first-time university students entering a full-time undergraduate degree program.

- Transfer, Mature, Diploma, Exchange, Special, Part-time and Visiting students are not eligible for entrance scholarships.

There are two types of centrally-administered entrance scholarships:

- One-year Scholarships, valued at $3,000 (non-renewable)

- Major Scholarships, valued between $3,000 and $12,000 (renewable annually up to 3 or 4 years provided criteria for renewal are met)

Need-based financial aid for future undergraduates:

Entrance Bursary Program

McGill University is committed to supporting the academic pursuits of qualified undergraduate students who require financial assistance. The University’s Entrance Bursary Program offers entrance bursaries to students from low to modest-income families who demonstrate financial need. Those eligible to apply include all:

- newly accepted, first-year, first-degree undergraduates, and

- newly accepted, first-year undergraduate direct entrants to professional programs in Medicine and Law (with prior degree)

Click here to learn more about the eligibility requirements and how to apply to the Entrance Bursary Program.

Direct Affiliation Scholarships.

Many organizations have scholarships for people who are affiliated with them. Think of these as perks of being in an exclusive club in your community! The smaller application pool means you have a higher chance of winning! Some affiliations include:

- Your employer – ask your boss if there are any scholarship opportunities through the company!

- Your parents’ employers – Your parents will most likely be aware of these opportunities, but make sure to ask them, just in case!

- Your sports club – Check your sports club website or ask your coach!

- Your bank – Google (your bank’s name) scholarships.

- The grocery store you use – Talk to someone at Customer service or do a quick Google search!

- Club that you or your parents are in – Perhaps your parents are members of a golf club, or something alike?

- Diagnosis related organization – Multiple diagnoses are supported by large organizations (Canadian Cancer Society, Crohn’s and Colitis Foundation). If you or a family member have been affected by a specific diagnosis, there may be a scholarship for you.

Check with distant family members to see if there are any scholarship granting clubs or associations that they are involved in. You can even bond with your grandparents, aunts or uncles over the application process!

Government Funding:

1. Student Loans: This is money from the government that you have to pay back once you complete your degree. While not a student’s first choice, there are many benefits involved, including access to specific scholarships, bursaries and grants. The loan’s value is determined by educational costs, family income, and other student resources.

2. Grants: These are non-repayable. You can apply for grants through your provincial student aid. You may be eligible to receive more than 1 type of grant. Once the application is submitted, you will be assessed for all the types available for you. Curious about how much you are eligible for? Try out this aid estimator!

3. Scholarships: Like grants, these are also non-repayable. The eligibility requirement varies on the type of scholarship. Here’s where you can find a few scholarships offered by the government.

4. Training & Employment Programs: These are part-time and full-time employment opportunities for students including those with disabilities and those who belong to the indigenous group. Interested in a job? Click here!

With all of these options, you have the opportunity to cover your entire McGill Tuition costs and possibly even graduate debt-free!

To access in-depth coaching and guidance on your scholarship application writing, check out the GrantMe platform! Our trained essay editors know exactly what the selection committees look for and can help you draft a winning supplementary application. We also provide personalized scholarship matches, essay editing, and mentorship from past winners to maximize your success. Complete our short scholarship eligibility quiz to learn more about how GrantMe can help you achieve your post-secondary goals.

Need help with the McGill application process? Check out these blogs to learn more about How to get Accepted to McGill and How to Apply to McGill.